If you feel like your tax code may be wrong you can contact HMRC to review and adjust your tax code if necessary. It’s common for higher rate tax payers to have more complex tax affairs which can result in an incorrect tax code being used.įor example if you have a company benefit like a company car your tax code needs to reflect the correct benefit to be accurate.

CURRENT HIGHEST TAX BRACKET FREE

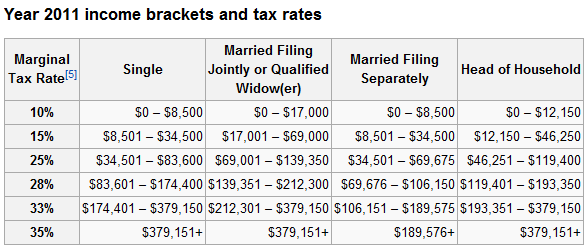

The tax code you are given by HMRC is directly linked to your tax free personal allowance and it’s important to ensure your tax code is accurate. Please read on to find out some of the ways you can increase your tax efficiency and reduce the amount of income tax you pay. One good thing about paying tax at the higher rate is you can get tax relief at the higher rate (instead of the basic rate of 20%) which will double the rebate you can reclaim. Being tax efficient is not the same as tax evasion or avoidance it’s just being financially savvy. You can find out about the current tax years tax free personal allowance and 40% tax bracket here.Ĭan I reduce my higher rate income tax bill? It’s important to know what the tax free personal allowance is and the 40% tax bracket to help you work out how much tax you should pay. The 40% tax bracket can change in each tax year but this depends on the decisions made by the government in the budget.Īn announcement by the government will be made each year confirming the new tax years tax free personal allowance and other tax bands. Does the 40% tax band change every tax year? Higher rate taxpayers also have to pay more than the standard 20% on any savings and on any income from dividends.ĭifferent tax rates and bands apply for Scotland. In this example you will pay 40% tax on your income over the £50,271 threshold and not on all of your income.Īny earnings you may have over £125,140 will be taxed at the additional rate tax band rate of 45%. Additional Rate tax band – 45% on any income over £125,140.Higher Rate tax band – 40% on income between £50,271 and £125,140.Basic Rate – 20% on income over £12,571 (standard Personal Allowance) up to £50,270.Standard Personal Allowance is £12,570.These are not set in stone and can change with every new tax year.įor example, salary boundaries for 2023/2024 tax bands: The amount of tax you pay on your income depends on your tax free personal allowance figure and which tax band you fall into. How much do I have to earn to pay 40% income tax?

0 kommentar(er)

0 kommentar(er)